refinance closing costs transfer taxes

There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on every refinance in Florida. State laws usually describe transfer tax as a set.

Closing Costs On House Purchase And Refinance Transactions Youtube

Purchase All counties use the same tax calculation for a purchase or.

. Form 1098 a mortgage tax form you receive from your mortgage company provides only information about the mortgage interest and property taxes paid in the prior year. If I borrow an additional 4k for closing costs with a remaining principal at time of refinance of 101 million. Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property thats changing hands.

Calculate recordation tax on a refinance. Generally deductible closing costs are those for interest certain mortgage points and deductible real estate taxes. DC MD VA.

You owned your new home during the property tax year for 122 days September 1 to December 31 including. Most people who buy a home or refinance an existing mortgage pay closing costs. Many other settlement fees and closing costs for.

Refinance Property taxes are due in November. 52 rows Note that transfer tax rates are often described in terms of the amount of tax charged. Figuring out the amount of your doc stamps.

Review tax rates try our closing cost calculator for refinances. When the same owners retain the property and simply. You closing costs are not tax deductible if they are fees.

In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due. Unfortunately this can also be costly as many different mortgage fees and closing. If you are refinancing a mortgage on a rental or investment property the rules are different.

In Florida transfer taxes are also referred to as documentary stamps or doc stamps and theyre typically paid by the seller. March 12 2020 1159 AM. Transfer taxes are not tax-deductible against your income tax but.

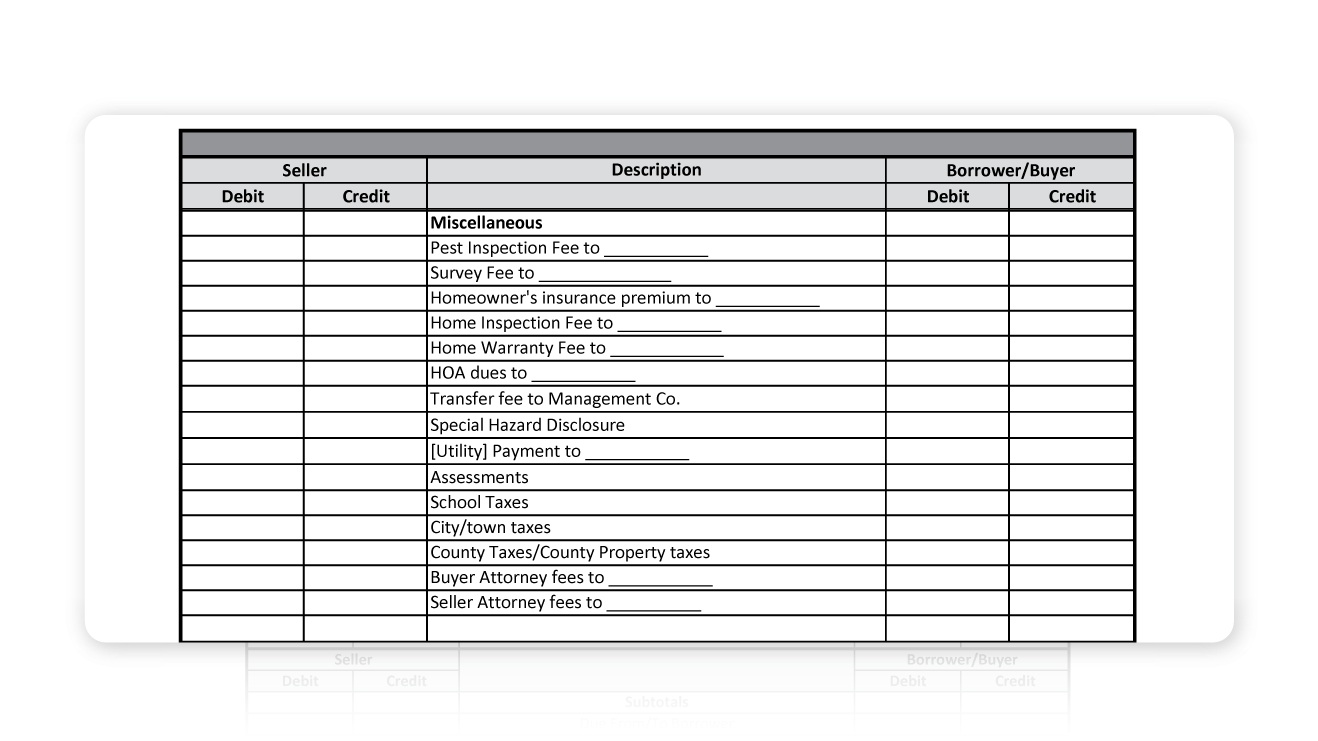

Title fees Attorney costs calculator VA Title Insurance rates. You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes. Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing.

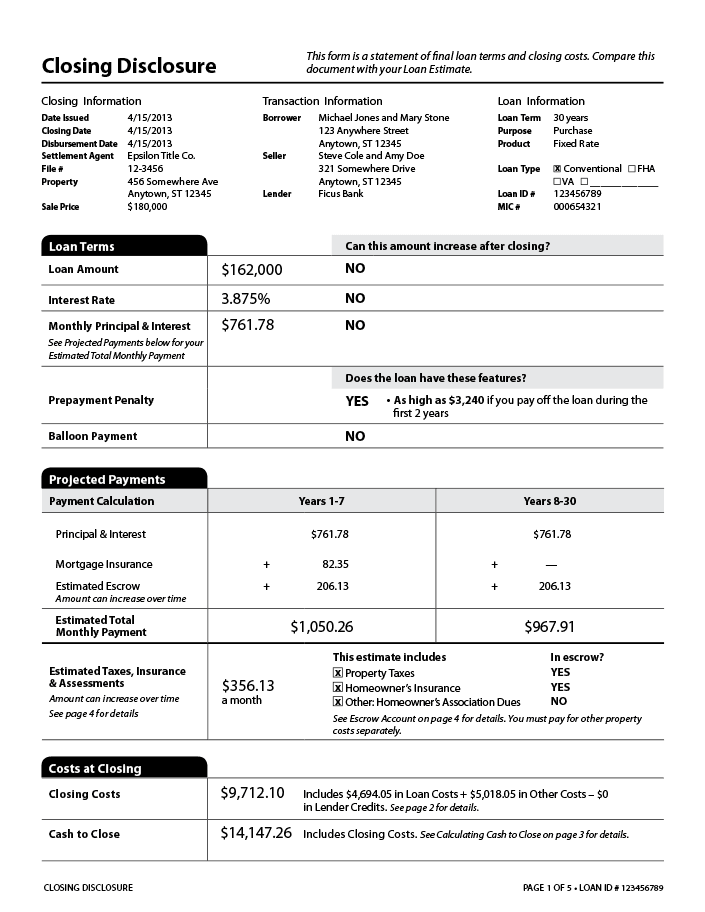

Thank you for the response. The IRS will let you deduct just about every closing cost that you incur when you. Youll typically pay mortgage refinance closing costs equal to between 2 and 6 of your loan amount depending on the loan size.

County Transfer Tax see chart. By Bryan Dornan bryandornan. National average closing costs for a single.

Virginia closing costs Transfer taxes fees 2011. Understanding Refinance Mortgage Tax Deductions in 2022. The tax for the year was 730 and was due and paid by the seller on August 15.

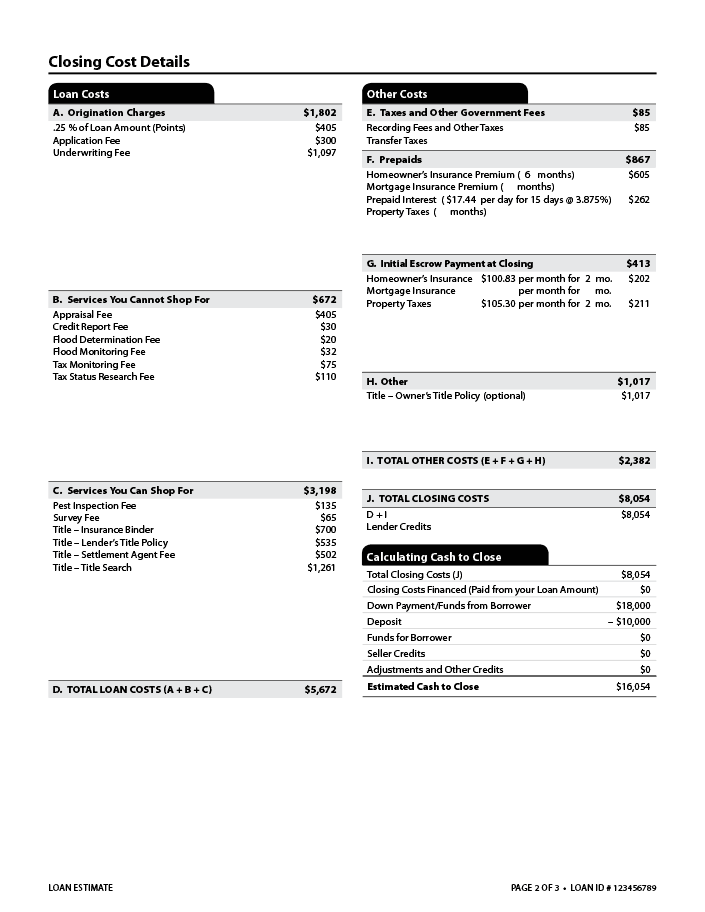

Transfer Tax 20 --15 County 5 State First 22000 used to calculate County tax is exempt if property is owner occupied Property Tax 1247 - per hundred assessed value. When you buy sell or refinance a home closing costs are a major part of every transaction. REFINANCE CLOSING COST CALCULATOR.

The Loan Estimate And Closing Disclosure What They Mean Nerdwallet

Is Refinancing Worth It How About For 1 Savings

Closing Costs That Are And Aren T Tax Deductible Lendingtree

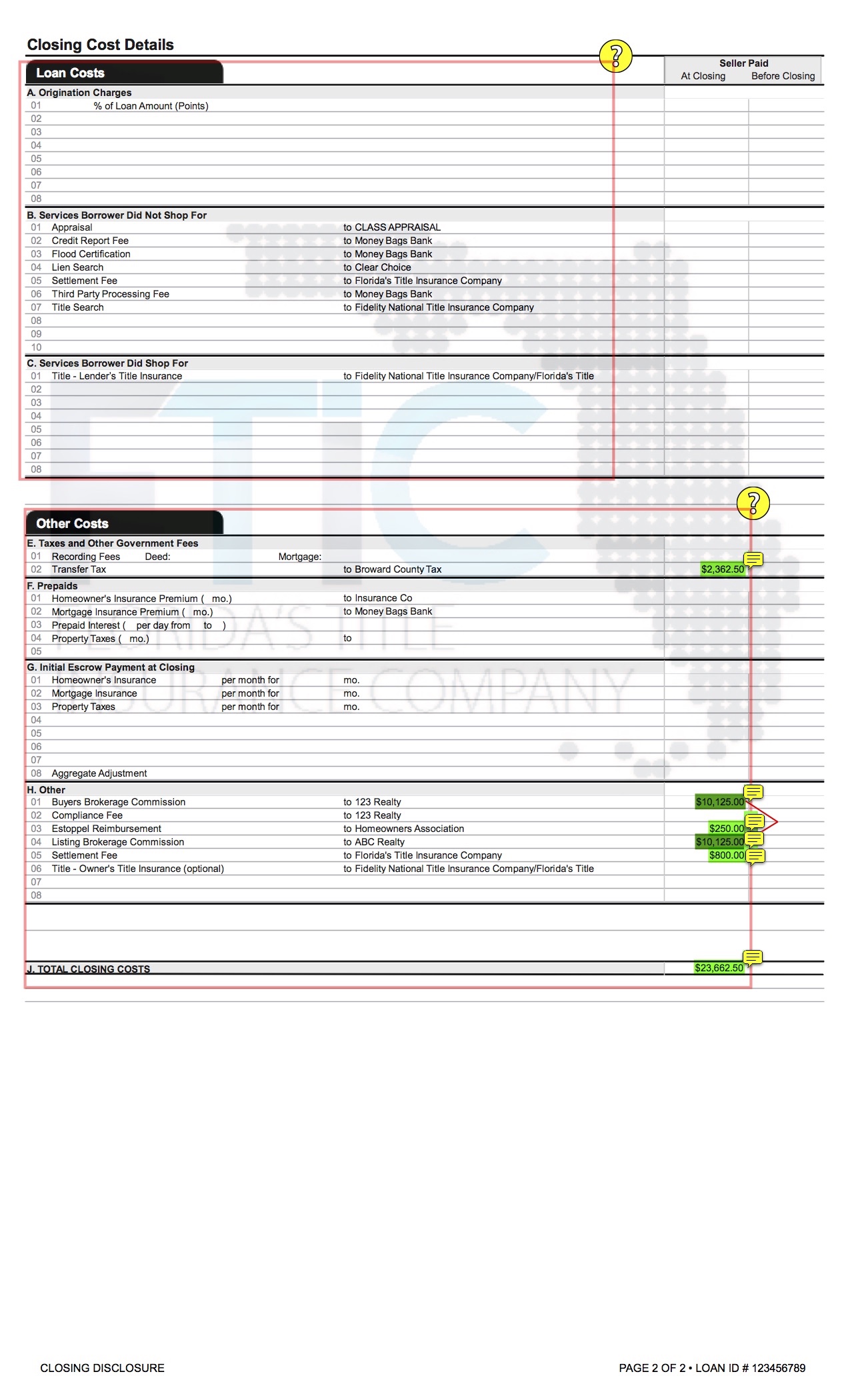

How To Read Seller S Closing Disclosure I E Seller S Closing Costs Florida S Title Insurance Company

How To Estimate Closing Costs Assurance Financial

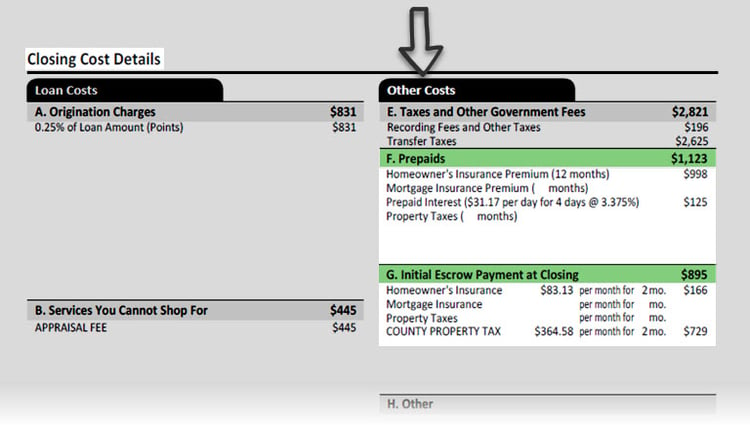

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Mortgage Refinance Tax Deductions Turbotax Tax Tips Videos

Should I Transfer The Title On My Rental Property To An Llc

Michigan Property Transfer Tax Calculator Calculate Real Estate Transfer Tax In Michigan

Pennsylvania Deed Transfer Tax 2022 Rates By County

What Are Closing Costs Jay Villella Real Estate Consultant

Texas Real Estate Transfer Taxes An In Depth Guide

Escrows Prepaids At Closing What You Should Know U S Mortgage Calculator

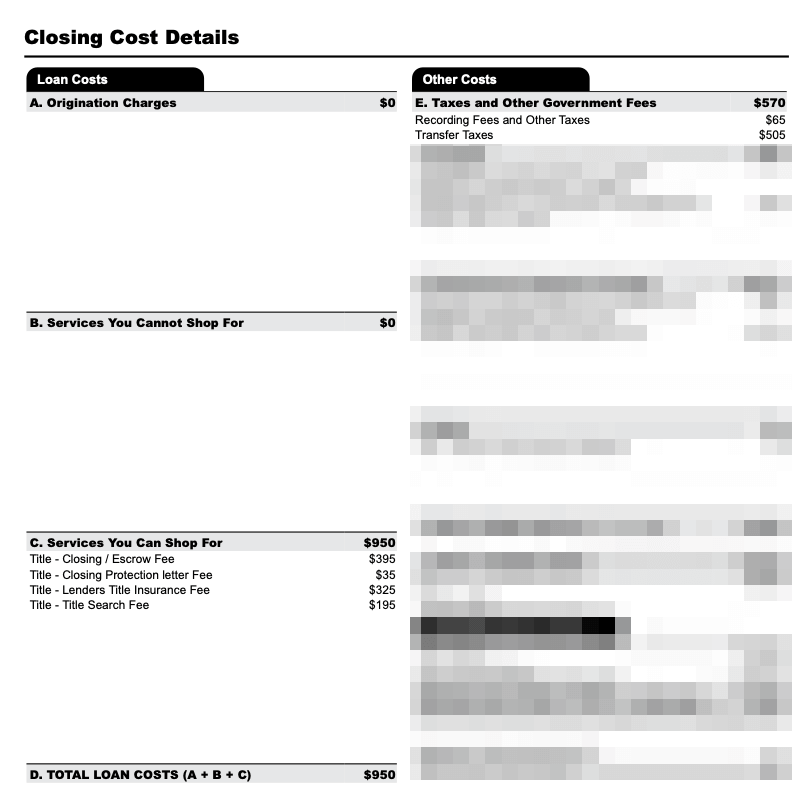

Loan Estimate Explainer Consumer Financial Protection Bureau

A Guide To Understanding Your Closing Disclosure Better Better Mortgage

How To Read The Alta Settlement Statement Download Alta Statement

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Closing Disclosure Explainer Consumer Financial Protection Bureau

Mexico Real Estate 101 Moxi By Moxi A Global Mortgage Company Issuu